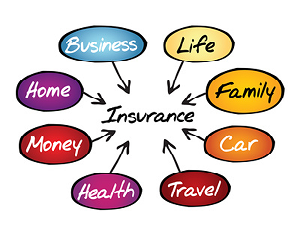

Chances are high that you might have already bought term and health insurance policies and now you are happy that you have properly protected yourself.

But before you put your insurance planning on a back seat, it is necessary to find out the gap in your insurance portfolio.

Your term insurance policy will pay money to your family only if you die.

In case you survive the term, you will not get anything in return. What if God forbid, you have an accidental disability which causes loss of income as well?

In addition to medical expenses, there will be other expenses like household expenditure, loan EMIs etc.; which you would have to deal with.

However, without income, you might find it difficult to deal with all these expenses. On the other hand, because you are alive, your term insurance company will not pay anything.

Consequence: You will have to pay all your medical expenses without any financial support from anywhere.

If after an accident, you are in a hospital, your health insurance policy will take care of your medical bills up to a certain limit. However, in addition to medical expenses, you may have to experience loss of income as well.

Consequence: You will have to pay the remaining medical expenses along with making proper arrangement to recuperate from the financial loss that may arise due to loss of income.

So where is the solution?

Even after buying health and term insurance policies, a gap is there in your insurance portfolio, which you can fill with a personal accident insurance policy only.

Mainly covering all sorts of disabilities, here are some of the benefits of purchasing a personal accident insurance policy:

- A basic accident insurance policy covers both accidental death and disability and can be further enhanced to get extra cover

- From minor to major, a personal accident policy covers all types of accidents ranging from falling off a stair at home, fracturing an arm while playing football to getting hit by a vehicle

- It is a useful policy as it offers coverage against partial, temporary, or full disability and even the loss of income

- Some of the policies are bundled with extra features like child education allowance, coverage for injuries caused due to terrorism, transportation of mortal remains, etc.

Some Horrifying Statistics:

- 400 road accident deaths/day took place in 2015

- Due to natural calamities, 20,201 people died in 2014

- 29,903 people died due to drowning in 2014

- Over 1.13 lakh people died in fire accidents in last six years

- total of 27581 Indians died in railway accidents in 2014

- More than 200 people died and 330 severely injured in train accidents in the last one year

When should you buy and how much coverage is sufficient?

Remember, accidents can happen even in four walls of your house, so, it is necessary to buy a personal accident insurance policy be 100 times of your monthly salary.

It means, if your monthly salary is Rs 5,000, your personal accident coverage should be minimum Rs 50,00,00.

Make sure to buy the policy when you are young because the chances of meeting with accidents are high during that phase of life.

How much payout is available?

It depends on the type of disability and injury, whether that injury is covered or not.

In case of death or loss of two limbs or hands, the insurer pays the entire sum insured, however, in case of loss of one eye or one hand, the insurer will pay half the amount.

The following is the payout made by most of the insurers:

| LOSS OF USE/ ACTUAL LOSS BY PHYSICAL SEPARATION OF | PERCENTAGE OF CAPITAL SUM INSURED |

|---|---|

| Sight of both eyes | 100% |

| Both hands | 100% |

| Both feet | 100% |

| One hand and one foot | 100% |

| One eye and one hand or one foot | 100% |

How to claim?

Indeed, the claim process of a personal accident insurance policy is simple as you don’t need to undergo any medical tests to prove your injury.

While, it is necessary to inform the insurer within the stipulated period, you only need to submit information like your contact details, policy copy, brief of the accident, medical report etc.

Once you have submitted all the necessary documents, your claim would be settled.

Is it costly?

No, not at all, in fact, the premium of a personal accident policy is much cheaper than term insurance policies.

For a Rs 5 lakhs personal accident insurance coverage, you will need to pay only Rs 1,482/year, which is around Rs 123 a day.

Moreover, the premium of a personal accident insurance doesn’t depend on the age of an applicant as it is the occupation which plays an important role in deciding the premium.

Therefore, a 25- year old crime reporter will pay higher premiums as compared to a 50-year old dentist.

Furthermore, when you decide to buy the policy online, you get lucrative discounts as well.

With online personal accident insurance policies, the insurer saves on policy administrative costs, which are then passed on to policyholders in the form of cheaper premium rates.

Also, some insurers offer long-term personal accident insurance policies for two or three years in one go. Go for such plans and save your money!

For the premium calculation, insurers can classify occupations under the following heads:

| CLASS 1 (LOW RISK) | CLASS 2 (HIGH RISK) | CLASS 3 (VERY HIGH RISK) |

|---|---|---|

| Teacher | Veterinary Doctors | |

| Dentist | Builders | Circus Performers |

| Accountant | Garage Mechanics | Professional River Rafters |

Standalone or rider?

If after reaching at this stage, you have decided to buy a personal accident insurance policy, the next step is to choose between a full-fledged insurance policy and rider.

It is strongly advised to go with a standalone personal accident insurance policy which is more comprehensive than a rider.

Further, a standalone policy covers various types of losses, including partial or temporary disability along with loss of income, whereas a rider covers only the accidental death and permanent disability.

Also, you might be covered under your corporate personal accident insurance, but still it is necessary to buy your personal accident insurance policy.

A personal accident coverage should be minimum 5-10 times of your annual salary, but your employer’s coverage may be of a lesser amount.

Further, the group personal accident insurance policy will cease to exist when you leave your job. You can also extend your individual accident insurance to cover your family members as well.

Remember, while you can’t stop accidents from happening, you surely can protect it by having a proper safeguard in the form of a personal accident insurance policy.

By the way, I hope you have the answer of the question—why personal accident policy is the first insurance that you should buy?